13 S PASSERINE PATH

HAMPSTEAD, NC 28443

Welcome to Sophisticated Living at 13 S Passerine Path, Hampstead, NC

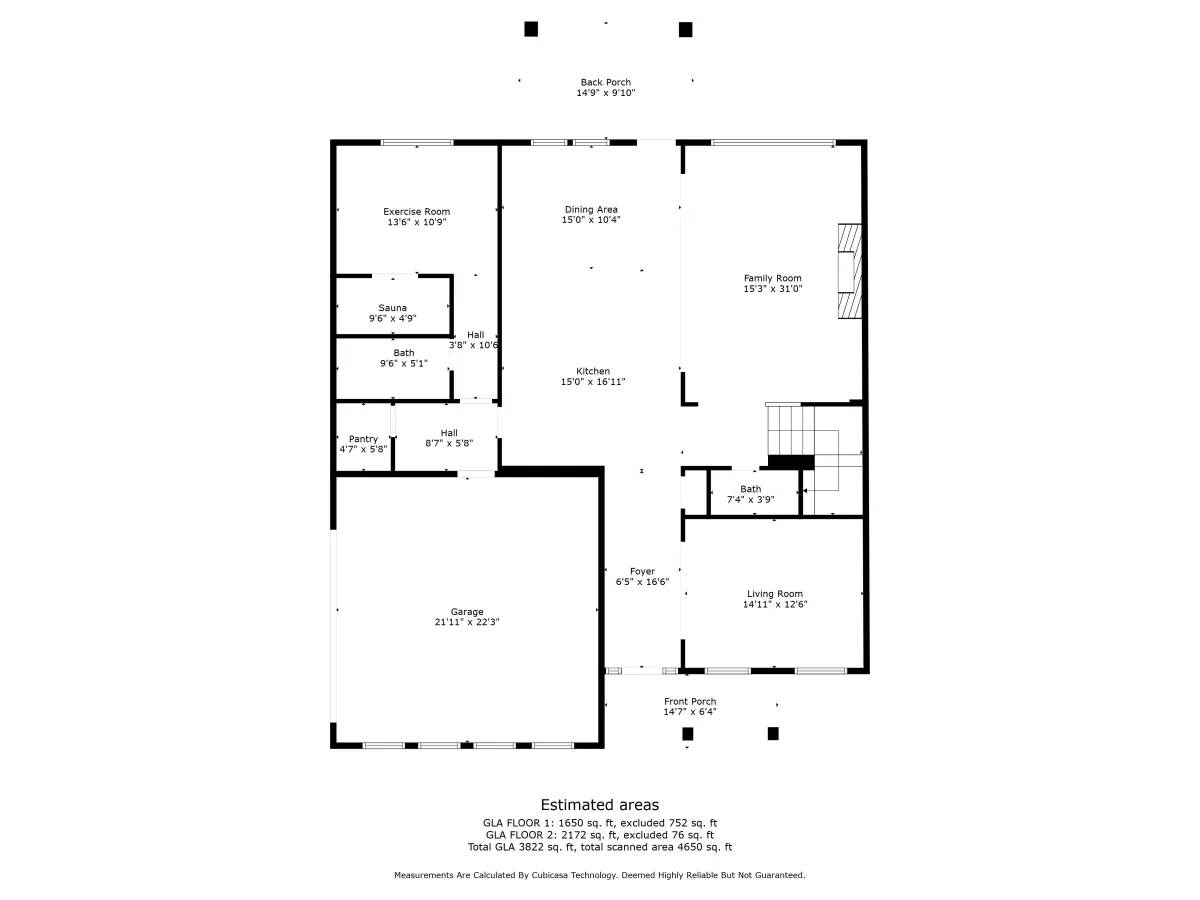

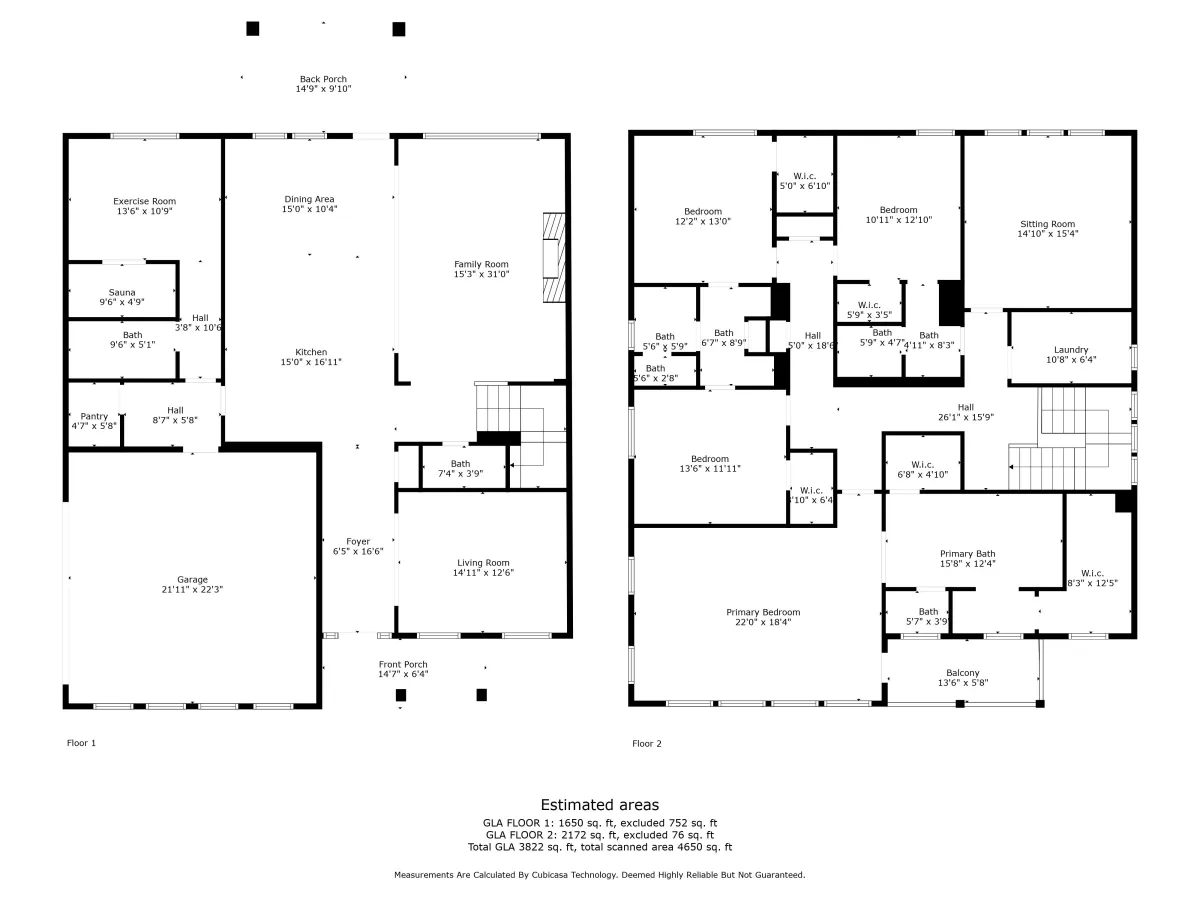

Step into a world of elegance and comfort with this sprawling 5-bedroom, 4.5-bathroom home, tucked away in picturesque Hampstead, NC. With a lavish 3750 sq ft of tastefully appointed living space, this home embodies the perfect blend of classic charm and modern luxury.

As you enter, be prepared to be taken aback by the stunning open-plan living area, boasting coffered ceilings that add a touch of sophistication. The heart of the home - the kitchen - does not disappoint either. A chef's dream, it is equipped with a suite of upgraded GE PROFILE appliances, a touchless Kohler faucet, and a beautifully crafted apron porcelain sink. The convenient pot filler is just another testament to the thoughtfully planned details that make this home stand out.

Off the main living area, discover a private bedroom complete with a full bathroom. Tucked away from the other rooms, this space provides an ideal setup for an in-law suite or guest room, offering privacy and convenience.

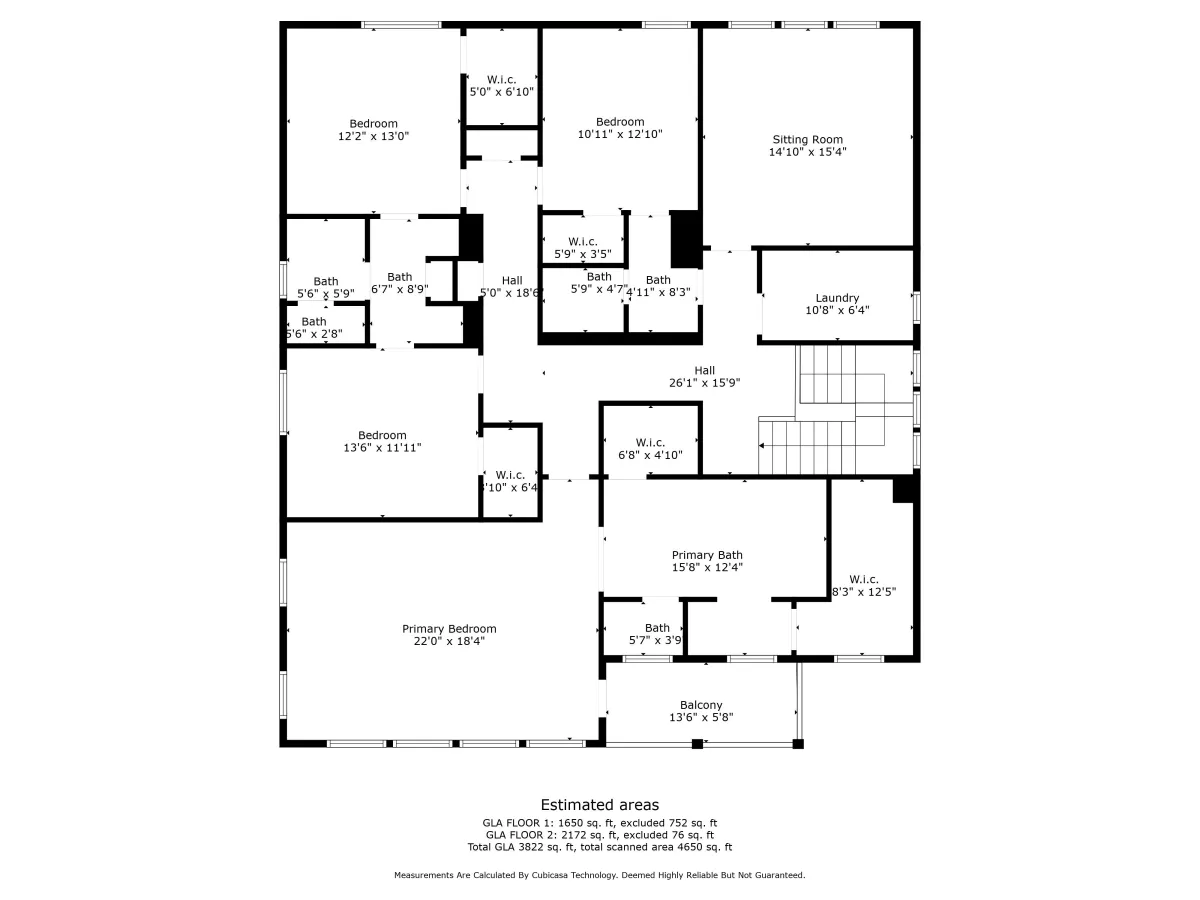

On the upper level, the master suite is an oasis of tranquility, boasting a tray ceiling, an extended his & her walk-in closet, and a custom vanity area in the master bathroom. A private balcony adjoins the master bedroom, presenting a serene spot for evening reading or sipping morning coffee. The remaining bedrooms and bonus room offer ample space for relaxation or work from home needs.

Outside, the home continues to impress with a heated saltwater pool, hot tub, and Wi-Fi-controlled LED lighting, creating the perfect setting for relaxation or entertaining guests.

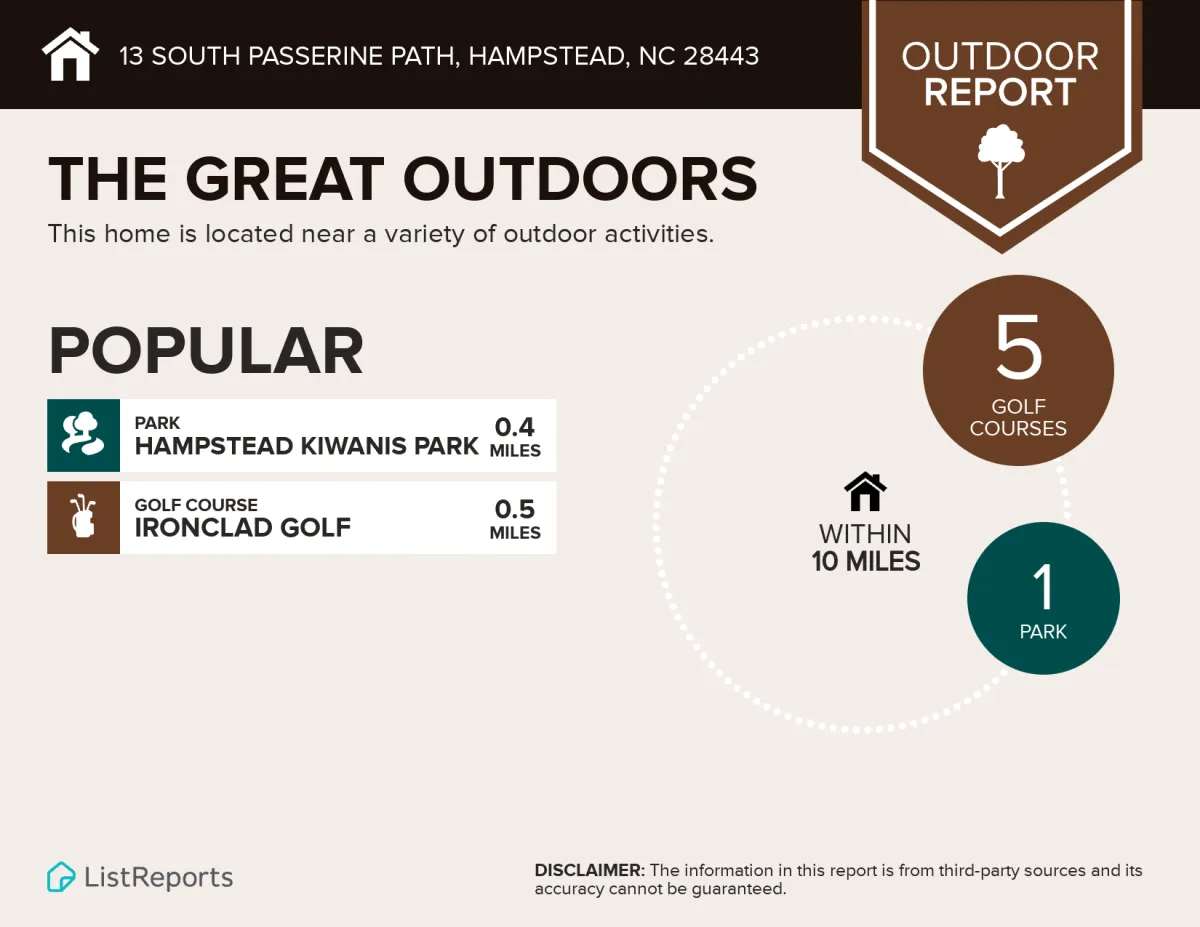

Located within walking distance of Kiwanis Park and only a 5-minute drive from a boat launch, the home offers an excellent balance of serene suburban living and outdoor recreational activities.

With all its interior and exterior upgrades, this home is a testament to a luxurious lifestyle. Experience the unparalleled blend of elegance, comfort, and convenience at 13 S Passerine Path, Hampstead, NC.

Contact us today for more information or to schedule a private tour.

Step into the 3D tour of 13 S Passerine Path, Hampstead, NC, and explore the grandeur of this home from the comfort of your own screen. Experience the elegance and detail in every corner as you navigate through this virtual walkthrough.

Custom Additions & Noteworthy Upgrades

Outdoor Enhancements & Distinctions

An Oasis at Home: Dive into the ultimate outdoor living experience with your heated, saltwater pool. This bespoke leisure space features seats at both ends, a relaxing hot tub, and a layout deck. Add a dash of spectacle with deck jets and LED color changing underwater lights. Every feature is fully automated and Wi-Fi accessible for your convenience. No need for a pool trip when you have the Leisure Pools experience right in your backyard.

Luxury Corner Lot: Your premium corner lot is a true showstopper. Boasting an upgraded side garage entry driveway and a fully fenced perimeter, privacy and convenience are at your fingertips. Delight in the beauty of your professionally designed front yard landscaping and enjoy the integration of hardscape paver front paths with the driveway.

Nurture Your Love for Gardening: Whether you're an avid gardener or just starting, you'll appreciate the raised garden beds with a greenhouse, along with the automated drip system installed in the front yard and backyard.

The Perfect Blend of Function and Aesthetics: Enhancements like a vinyl fence screening for pool equipment and propane tanks maintain the property's elegant look, while the 50Amp 220 whole house portable generator electrical hookup ensures you're ready for any situation.

Comfort & Leisure: From the playground and trampoline for family fun, to the BBQ gas hook-up for weekend cookouts under your covered backyard porch, this home prioritizes leisure as much as functionality.

Download a full list of exterior upgrades below!

Inside Elegance & Exceptional Enhancements

Sophisticated Interiors: Bask in an atmosphere of elegance accentuated by designer ceiling lighting and Pottery Barn curtain rods. The two main living areas boast coffered ceilings, and the family room features a cozy fireplace, cultivating an inviting atmosphere for relaxation and entertainment. The downstairs bedroom offers an extended walk-in closet, providing ample storage for your comfort. Meanwhile, the master bedroom's tray ceiling adds an extra touch of sophistication, further enhancing your private retreat

Gourmet Kitchen: Embrace your culinary aspirations with a kitchen designed for a chef. GE upgraded Gourmet PROFILE appliances, including a Gas Cooktop - Oven/Micro Combo with a convection microwave (upper oven), are at your service. The Kohler touchless faucet, pot filler, and apron porcelain sink add both function and elegance.

Elevated Comfort: Revel in the luxury of coffered ceilings in two main living spaces, a cozy fireplace in the family room, and an extended walk-in closet in the downstairs bedroom. The master bedroom's tray ceiling adds a touch of sophistication, while the makeup vanity in the master bathroom enhances your daily routine.

Quality Craftsmanship: DuChateau Wood Floors grace the upstairs, elevating the elegance of the interiors. The entire house is fully insulated, both inside walls and between floors, ensuring an energy-efficient and noise-reduced home. Medicine cabinets were added in bathrooms, and built-in wooden shelves enhance storage options.

Holistic Health: You'll appreciate the installed water filtration system, ensuring non-salted hard water and fluoride removal for your health and wellness.

Download a full list of exterior upgrades below!

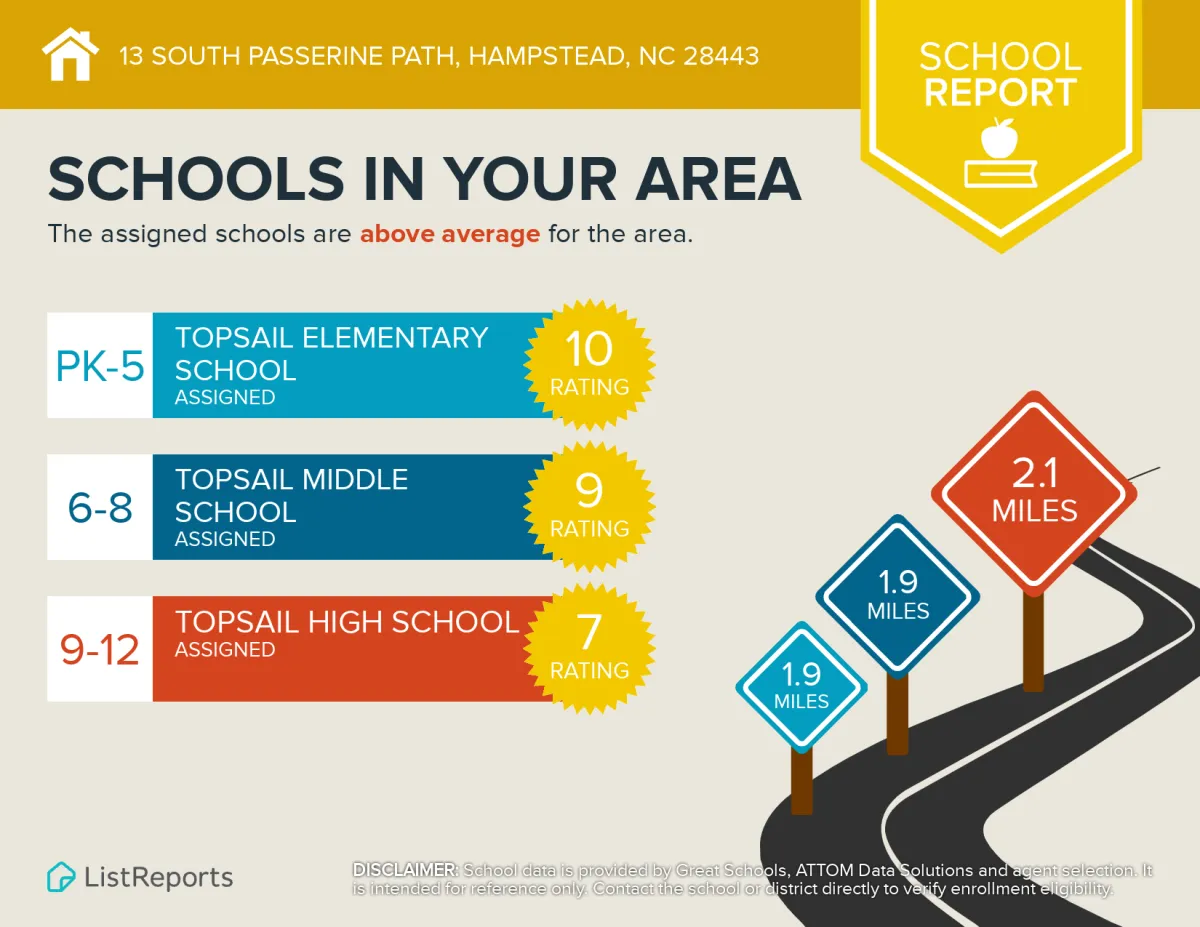

Discover Your Community

To contact agent with questions or to schedule a showing, please complete the form below.

A note from the sellers:

Imagine a home not just built, but one that's crafted with heart and a keen sense of belonging. In Hampstead, we found more than just a house; we found a sanctuary where life blossoms.

Every corner of this residence is designed for a life brimming with passion and purpose. The seamless fusion of indoor and outdoor spaces makes it the quintessential setting for work, relaxation, and recreation. Whether you're a family stepping into a new chapter, a retiree looking for tranquility, or a multigenerational household cherishing shared moments, this home embraces you.

The location is ideal. Dream of a morning walk on the community pathway to Kiwanis Park or by the beach? It's just moments away. Yearn for an adventurous day of boating, paddleboarding, or kayaking? The launch is five minutes away.

Nature lovers, rejoice! The vibrant Kiwanis Park is so close it feels like an extension of your own backyard. Jogging trails, playgrounds, sports fields, and year-round events promise endless memories. The soulful summer concerts and magical winter tree lightings beckon a community spirit that's hard to find elsewhere.

Poplar Grove Abby Nature Preserve is a short drive away, offering a serene escape. And for those who fancy a day of golfing or craving a bite at Shaka Tacos, you're in luck! They're just a walk away. And let's not forget the nearby pickleball court for an invigorating game with friends.

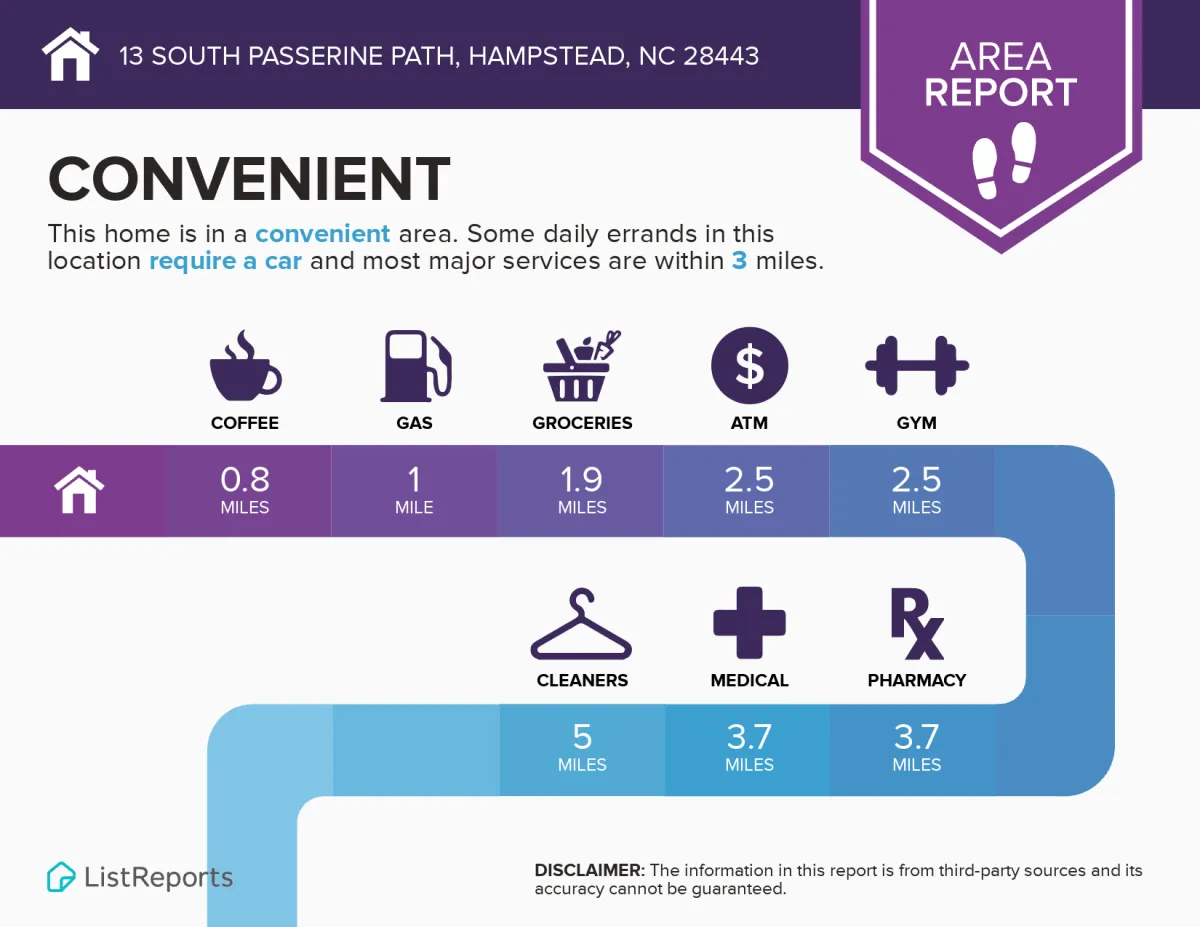

For the practical side of life, grocery stores, eateries, gas stations, and even a library are close at hand, ensuring that daily necessities are always within reach.

In Hampstead, we didn't just find a house; we found the embodiment of home. And we believe you'll feel the same. Welcome home.

Pre-Approval vs. Pre-Qualification: Understanding the Difference for a Smoother Home Buying Journey

Pre-Approval vs. Pre-Qualification: Understanding the Difference for a Smoother Home Buying Journey

Pre-Approval vs. Pre-Qualification: Understanding the Difference

In the process of buying a home, you may come across terms like pre-approval and pre-qualification. While they sound similar, they serve different purposes and have varying levels of importance in the home buying journey. Understanding the difference between pre-approval and pre-qualification is crucial for making informed decisions and maximizing your chances of securing a mortgage. Let's delve into these concepts and explore their nuances.

What is Pre-Qualification?

Pre-qualification is an initial assessment of your financial standing and creditworthiness conducted by a lender. It provides a rough estimate of the loan amount you might be eligible for based on the information you provide. Pre-qualification typically involves a brief conversation or the completion of an online form.

The purpose of pre-qualification is to give you an idea of how much you can afford and which mortgage options may be suitable for your situation. It helps you gauge your purchasing power, but it does not carry the same weight as a pre-approval.

What is Pre-Approval?

Pre-approval is a more thorough evaluation of your financial background, credit history, and income stability. It requires documentation and verification of the information provided. The lender carefully reviews your financial profile to determine the maximum loan amount they are willing to lend you.

The purpose of pre-approval is to give you a clear understanding of your budget and strengthen your position as a serious buyer. With a pre-approval in hand, you can confidently make offers on properties knowing that you have already been vetted by the lender.

Key Differences between Pre-Qualification and Pre-Approval

Level of Scrutiny

Pre-qualification involves a basic assessment that relies heavily on the information provided by the borrower. The lender does not verify the details and relies on estimates. In contrast, pre-approval requires extensive documentation and a thorough evaluation of your financial history. It involves a comprehensive credit check and examination of your income, assets, and debts.

Documentation Requirements

Pre-qualification typically requires minimal documentation. You may be asked to provide basic information about your income, assets, and debts. On the other hand, pre-approval demands a more extensive collection of documents. This may include pay stubs, bank statements, tax returns, and other financial records. The lender scrutinizes these documents to verify your financial stability and assess your ability to repay the loan.

Accuracy of Information

Since pre-qualification is based on the information you provide, it is less accurate compared to pre-approval. The lender does not delve deep into verifying the details during pre-qualification. In contrast, pre-approval involves a thorough verification process, ensuring the accuracy of the provided information. This makes pre-approval a more reliable indicator of your loan eligibility.

Confidence in the Loan Amount

Pre-qualification gives you a general idea of the loan amount you may qualify for. However, it does not provide a guarantee. The actual loan amount can differ after the lender conducts a more comprehensive analysis during pre-approval.

With pre-approval, you have a higher level of confidence in the loan amount. The lender assesses your financial situation, creditworthiness, and other factors, providing you with a specific loan amount that you are approved for. This allows you to search for homes within a more accurate price range.

Seller's Perspective

From a seller's perspective, a pre-approval carries more weight and demonstrates your seriousness as a buyer. It shows that you have taken the necessary steps to secure financing and are more likely to follow through with the purchase. Pre-qualification, while helpful, does not provide the same level of assurance to sellers.

Benefits of Pre-Qualification

While pre-qualification may not be as comprehensive as pre-approval, it still offers several benefits:

Quick and Easy Process: Pre-qualification is a simple and fast process that can be completed online or over the phone. It gives you an initial idea of your affordability without requiring extensive documentation.

Estimate of Affordability: Pre-qualification helps you gauge your purchasing power. It provides an estimated loan amount, allowing you to narrow down your search and focus on properties within your budget.

Helpful for Initial House Hunting: Pre-qualification is particularly useful in the early stages of the home buying process. It gives you a starting point to explore mortgage options and assess potential affordability.

Benefits of Pre-Approval

Pre-approval offers several advantages that can greatly enhance your home buying journey:

Increases Your Bargaining Power: With pre-approval, you have a competitive edge in negotiations. Sellers are more likely to consider your offer seriously, knowing that you have already undergone a thorough evaluation by the lender.

Provides a More Accurate Budget: Pre-approval gives you a specific loan amount, allowing you to set a realistic budget. You can confidently search for homes within that price range, avoiding disappointments caused by overestimating your affordability.

Helps You Stand Out as a Serious Buyer: In a competitive real estate market, sellers often prioritize buyers who have been pre-approved. Having a pre-approval letter shows that you are financially prepared and ready to proceed with the purchase.

When to Use Pre-Qualification

Pre-qualification is most beneficial in the early stages of your home buying journey:

Early Stages of the Home Buying Process: When you are initially exploring the possibility of homeownership, pre-qualification can give you a starting point. It provides an estimate of your affordability, helping you determine whether buying a home is feasible.

Exploring Mortgage Options: Pre-qualification allows you to explore different mortgage options and understand the potential loan amounts and interest rates you may qualify for. This knowledge can help you make more informed decisions about the type of mortgage that best suits your needs.

When to Use Pre-Approval

Pre-approval becomes more crucial when you are ready to make an offer on a specific property, especially in a competitive real estate market:

Ready to Make an Offer on a Specific Property: Once you have identified a property you wish to purchase, obtaining a pre-approval gives you the confidence to make an offer. Sellers are more likely to consider your offer seriously when you provide a pre-approval letter along with it.

Competitive Real Estate Market: In a market where multiple buyers are vying for the same property, having a pre-approval sets you apart from other potential buyers. It signals to sellers that you are a qualified buyer and increases the chances of your offer being accepted.

Conclusion

In summary, while pre-qualification and pre-approval are both important steps in the home buying process, they serve different purposes. Pre-qualification provides an initial estimate of your affordability, whereas pre-approval involves a more rigorous evaluation and provides a specific loan amount.

While pre-qualification is beneficial for initial house hunting and understanding your financial standing, pre-approval carries more weight in negotiations and gives you a more accurate budget. It demonstrates to sellers that you are a serious buyer and helps you stand out in competitive markets.

To maximize your chances of securing a mortgage and finding the right home, it is advisable to utilize both pre-qualification and pre-approval strategically based on the stage of your home buying journey.

FAQs (Frequently Asked Questions)

Is pre-approval necessary? Pre-approval is not mandatory, but it offers significant advantages. It strengthens your position as a buyer, increases your bargaining power, and provides a more accurate budget for house hunting.

Can pre-qualification affect my credit score? Pre-qualification typically involves a soft credit inquiry that does not impact your credit score. However, if you proceed to pre-approval, a hard credit inquiry may be conducted, which can have a minor impact on your credit score.

How long does pre-approval or pre-qualification last? The duration of pre-approval or pre-qualification varies. Typically, they are valid for a few months, but it is advisable to check with your lender for the specific timeframe.

Can I switch from pre-qualification to pre-approval? Yes, you can transition from pre-qualification to pre-approval by providing the necessary documentation to the lender. This allows for a more comprehensive evaluation of your financial profile.

Should I get pre-qualified or pre-approved first? It is generally recommended to get pre-qualified first, as it gives you an initial understanding of your affordability. Once you are ready to make an offer on a property, obtaining pre-approval is crucial for a more accurate assessment and increased negotiating power.

Got questions?

910.690.6174

or E-mail: [email protected]

Grow Local Realty | Copyright © 2020 | All Rights Reserved